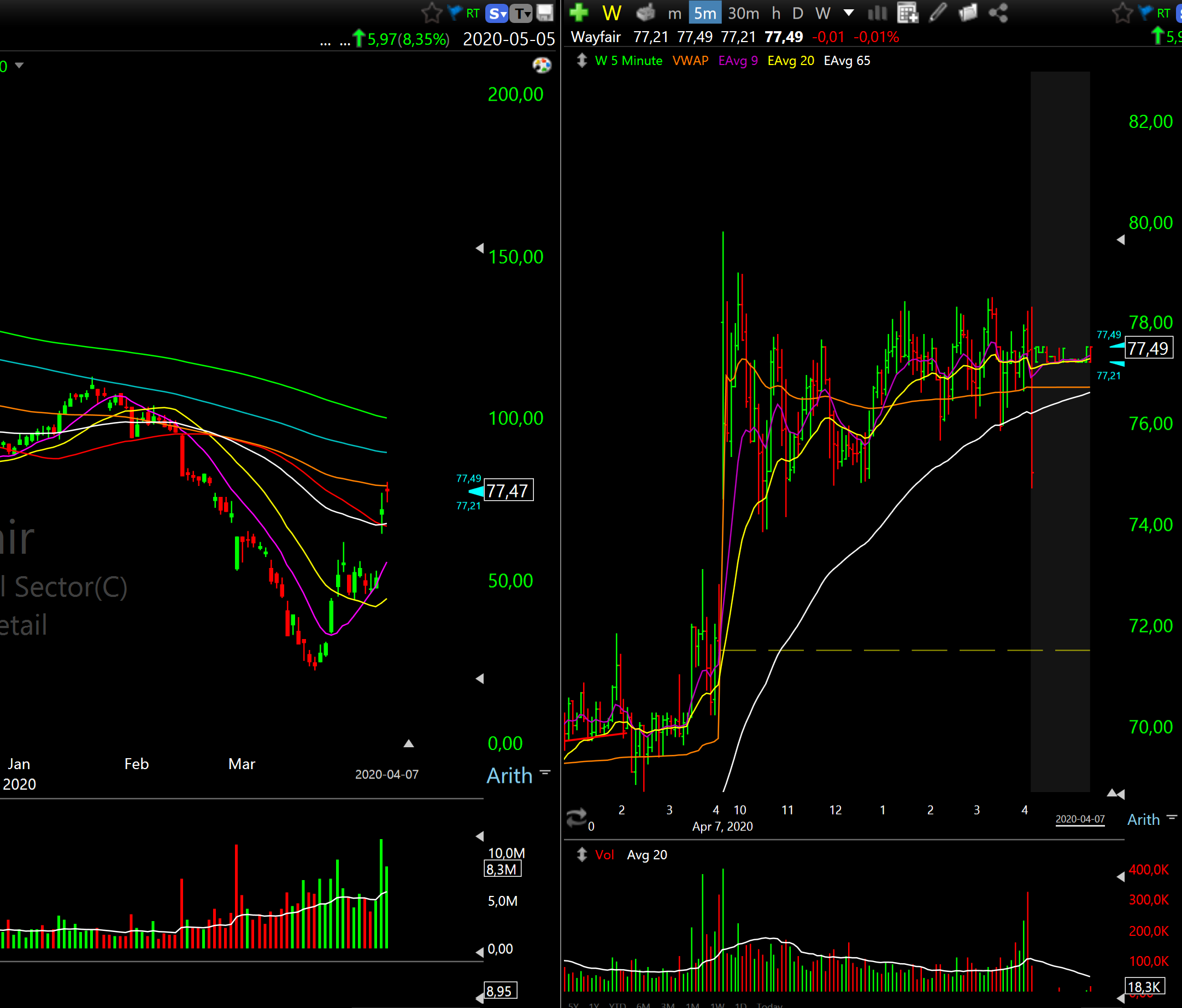

The markets had a big gap up today and premarket $W was one of my top setups to short as it is up 240% in 2 weeks and gapped into some resistance areas and I reasoned

a 15-25% fade back over the next 2-5 days would not be unreasonable.

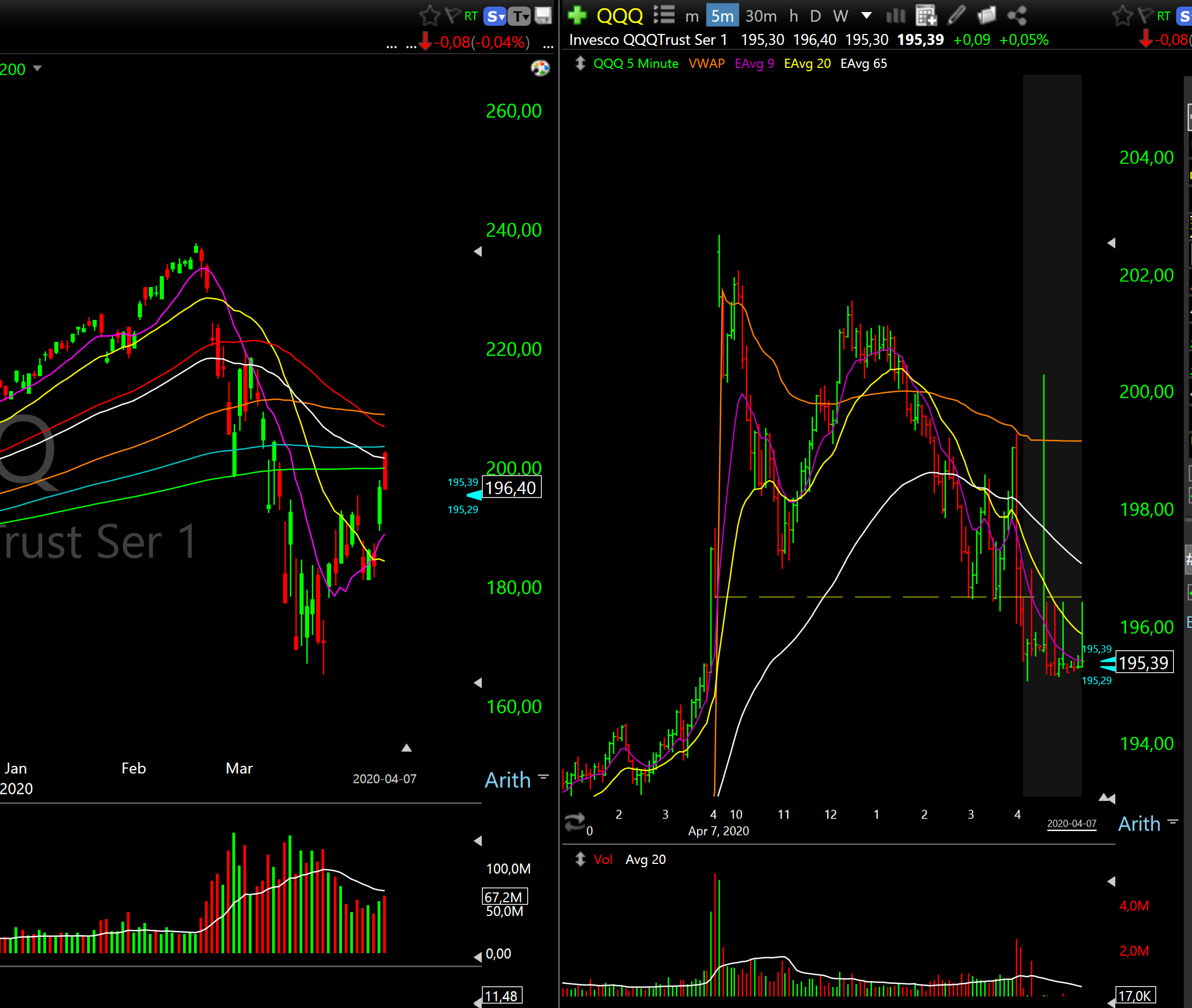

The markets could not hold the gap and faded soon after the open, bounced a little bit mid day and the faded into the close.

Unfortunately $W never broke lower, instead it traded in a “range of death” all day where it looked like it was going to break lower several times, instead ripping higher back into range. I scaled in and out several times during the day – with some size, hence the $140K loss I accumulated.

Looking back, there were many stocks in the casino, cruiseline and airline industries that had very clean fade charts intraday, I just happened to focus on the strongest one.

Below are $W and $QQQ daily and 5-minute charts where you can see the “range of death” in $W and the clean and defined ranges in $QQQ.

The lesson from this is that sometimes you just choose the wrong trading vehicle and that’s that. Need to have a short memory and move on.

Praying for another big gap up in the markets tomorrow for some new opportunity on the short side, probably something other than $W though.

Ryan

I felt W was shortable on front side. I profited nicely when it dropped to 67s. Then double dip when it hit 70s. Added 75s and been stuck since then as it hit 85s and 86s bjg resistance pocket. I refuse to let it squeeze me out in this bear market rally.

I am trading other tickers you mentioned RCL CCL and WYNN, bunch of REITs also. Buy and short.

I believe it will fill that huge gap in coming weeks.

My mistake was over looking earnings related news and huge gap up that held above opening price. These types are often sustainable even in weak markets, let alone a strong rally.

I follow you on Twitter. Is there a way we could chat or email privately?

Kristjan Kullamägi

You can DM me on twitch when I stream