I’m writing this post to help me find and identify stocks to invest/trade in.

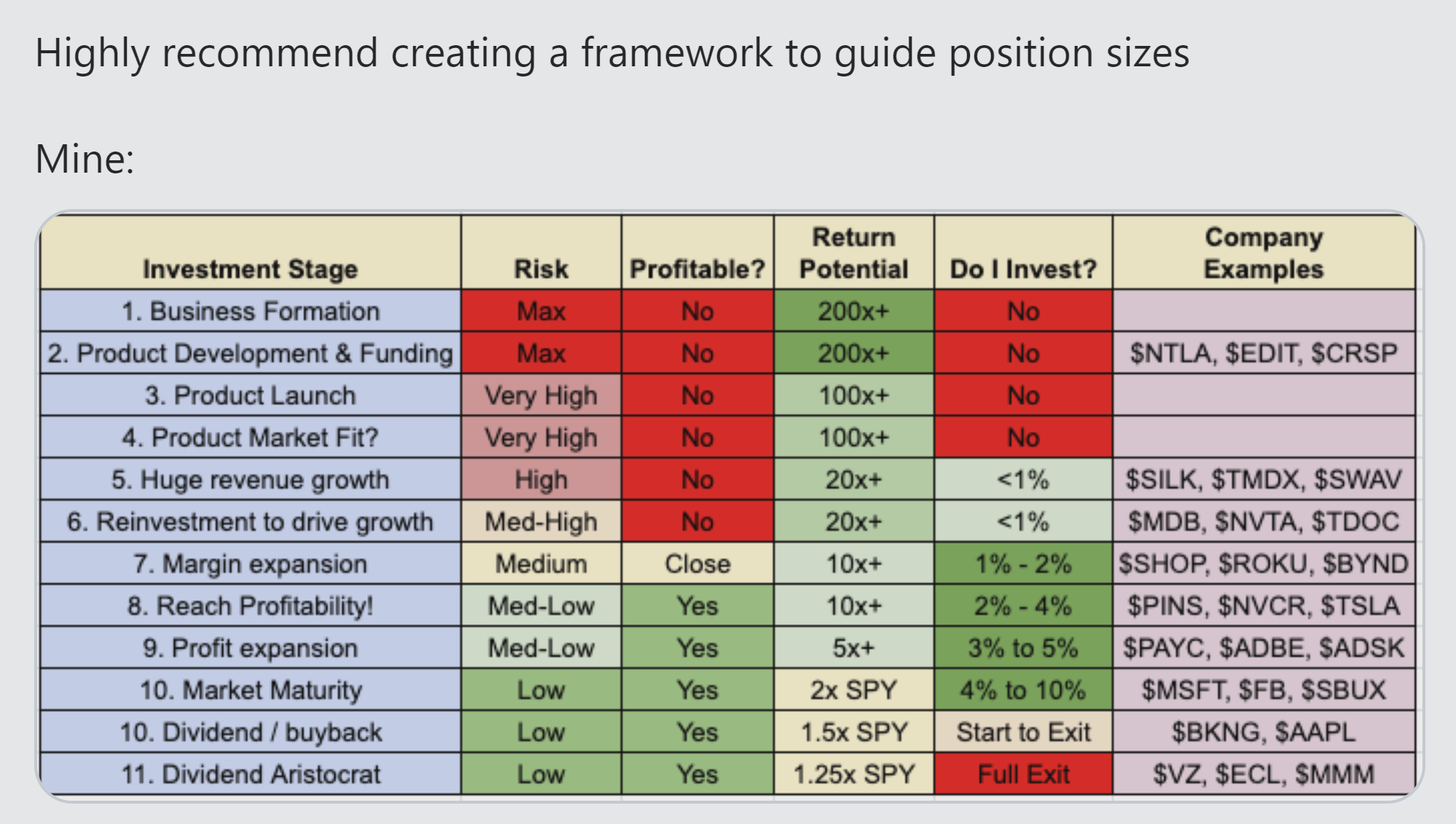

I found this table of the different stages of a company:

Source: https://twitter.com/BrianFeroldi/status/1245720168912826370

Peter Lynch classifies stocks into 6 groups:

1. Fast growers. 25%+ earnings growth.

2. Medium growers (stalwarts). Steady 10-12% earnings growth.

3. Slow growers (sluggards). No or very little growth but they often pay generous dividends.

4. Cyclicals. Sales and profits fall and rise in regular but not completely predictable fashion. These do well when economies come out of a recession and begin to expand.

5. Turnarounds. Stocks that go through deep troubles and their survival may come into question. If they manage to fix their issues they can have big rebounds that are the lest correlated to the overall market.

6. Asset plays. Hidden assets.

I want to operate in stages 5-8 on the table and mainly in the fast growers among the Lynch definitions. But I can’t rule out operating in turnarounds and cyclicals occasionally.

Smoke Frog (@mc_ees)

https://twitter.com/BrianFeroldi/status/1245720168912826370 ?

Kristjan Kullamägi

Thank you!

Rohit Kaler

Hi Kristjan

This is Rohit Kaler from India. Well I’ll try and keep it short. I heard your podcast on Chat with traders and was quite impressed by the way you operate as far as trading is concerned.

I am an avid follower of Warren Buffett ,not because of the kind of money he has made ,but also because of high level of honesty and integrity he has operated with in his field of Investing.

But to emulate the ideas of Mr Buffett as far as investing is concerned is a long long process for a person with a very minute capital like me.I believe Investing can make whole lot of difference if one has capital running in at least in Millions.

Right now I am just following blogs and watching youtube videos to devour as much knowledge as I can but the blessing of a teacher is always Imperative to be successful in respective streams of profession.

Therefore I would be greatly obliged If you can assist me in the field of trading (especially swing/momentum), like from where and how to start, what books to read etc etc

I have zero knowledge about charts, patterns, (10,20,5,100 day moving averages) hence you can understand the kind of work required in this long road ahead.

Investing/trading has become a passion for me and I cannot see my self doing anything else.

Look forward to hear from you man.

Regards

Rohit Kaler

Kristjan Kullamägi

Hi, I don’t do mentorship but you can check this link for more information and help for trading https://chartsandstories.com/start-here/

Good luck!

Uri

Hi Kristjan,

I read that your Win Rate is 25% …

for me it will be hard to take so many losses until I find a big winner…

I use an edge that it’s a little different: small profit with higher win rate…

Win Rate = 85%

win/loss ratio 0.4

and can generate around 50 trades/month….

what do you think of this edge, and do you think that it’s possible to generate returns of +100% per year with these numbers?

thanks

https://www.israelxclub.co.il/

I have to thank you for the efforts you have put in writing this site. I really hope to view the same high-grade content by you later on as well. In fact, your creative writing abilities has inspired me to get my very own blog now 😉