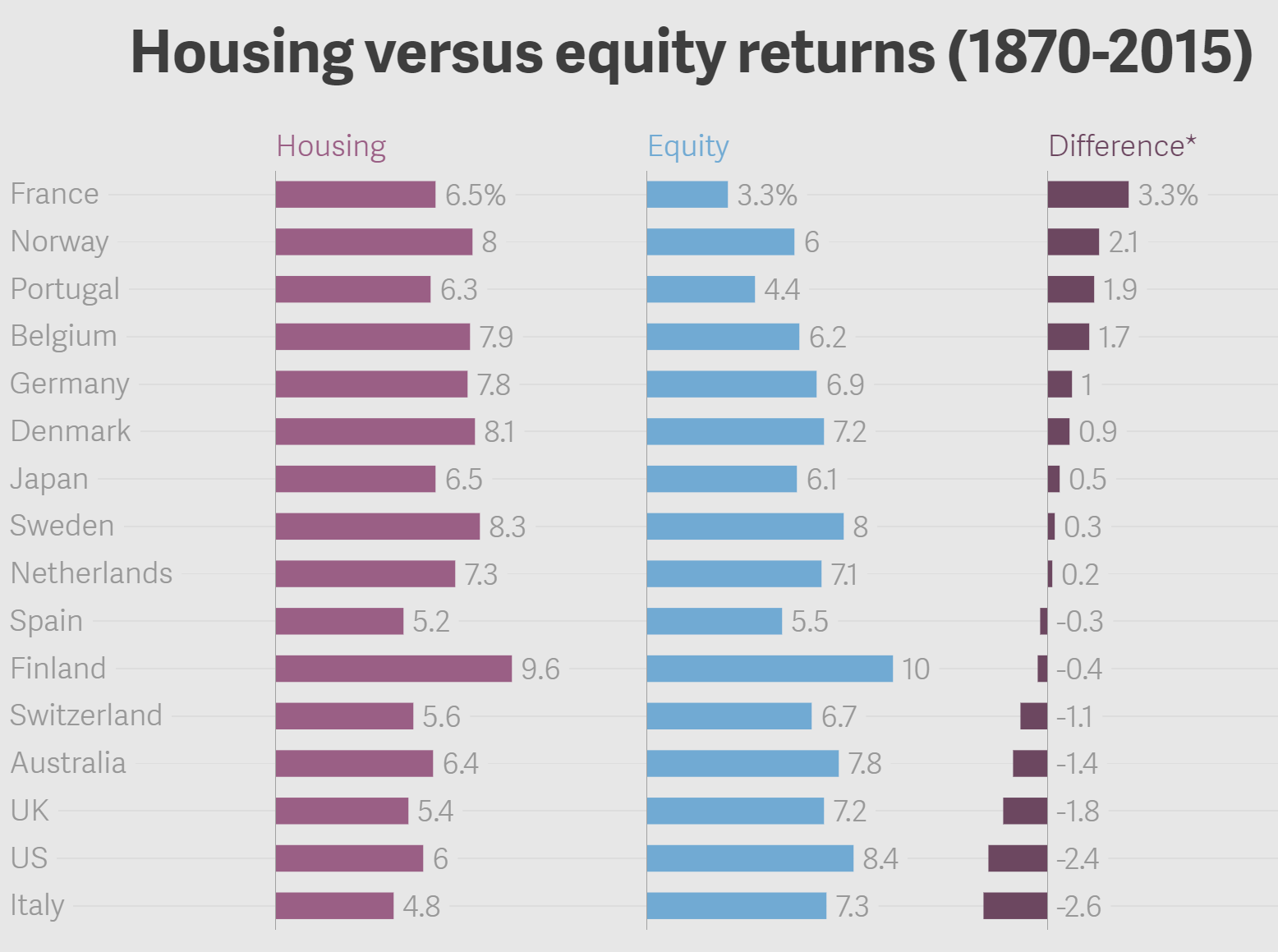

There’s an interesting study from several years ago that looked at the returns of some major asset classes over the past 150 years (where there is data).

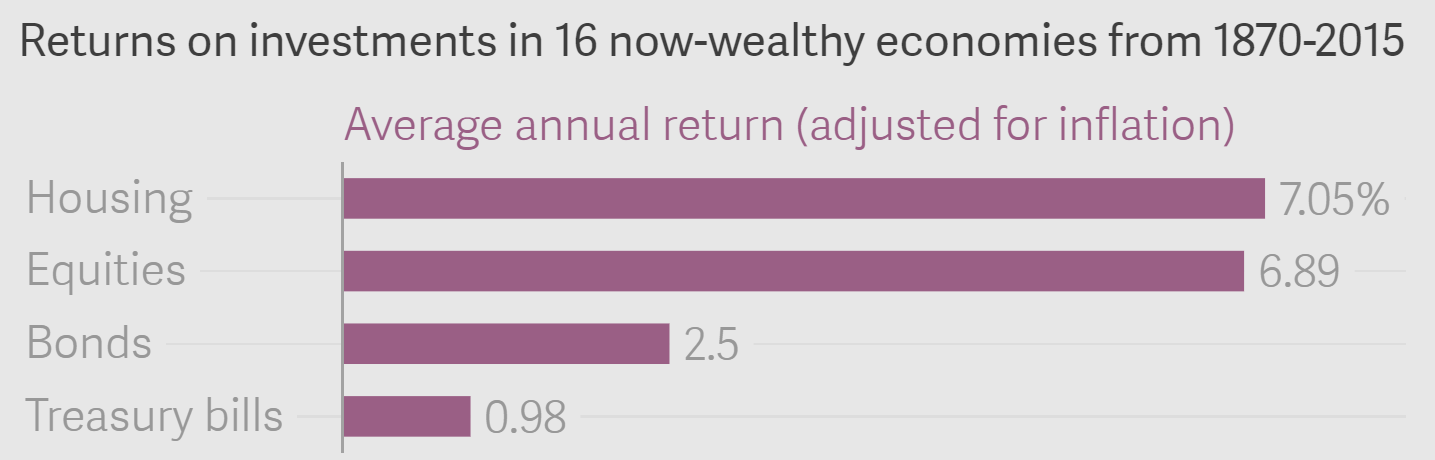

One of the main takeaways from the study was that higher risk does not equal higher return, as housing showed slightly better overall returns with less volatility than equities.

The standard deviation was 10% from housing and 22% for equities.

The interesting thing is that bonds had similar volatility to housing yet much less returns.

Why did housing and equities perform the best? Because both are cash flow generating assets, not only appreciating in price, but also paying rent and dividends.

Sources:

https://academic.oup.com/qje/article/134/3/1225/5435538

https://qz.com/1170694/housing-was-the-worlds-best-investment-over-the-last-150-years/

Nor

Hello Kris, greetings from SF Bay Area. Big fan of your streams. If you’re not already familiar with the CS annual GIRY reports, they’re a treasure trove of long term asset class returns and observations. One of my favorite macro research sources. Each year there’s a different theme, 2019 was Emerging Markets but they often do very long term comparisons on various other global asset classes as well: https://www.credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/csri-summary-edition-credit-suisse-global-investment-returns-yearbook-2019.pdf

Kristjan Kullamägi

Thank you! I am aware of the CS reports, going to dig in the one you linked. Thanks!

Reilly

Kristjan, didn’t realize you were into this sort of stuff.

You might enjoy some of these articles. There are a few in there regarding these sorts of commonly held assumptions.

https://verdadcap.com/weekly-research

I liked these:

https://verdadcap.com/archive/the-problem-with-asset-allocation

https://verdadcap.com/archive/contrarian-investing-in-commodity-cyclicals

https://verdadcap.com/archive/the-case-for-international-diversification

Kristjan Kullamägi

Thanks!

ivano

not an expert but if you like these long terms data, there is possibly a nice book from the chief equity trader from GS that spent some time making long time statistics on the SP500 in the first chapter(as you follow the relative strength/weakness you may like I hope/bet). They have a top down fundamental-ish approach, but is really cool to me because was written last year, is relatively unknown and goes really deep into bull/bear cycles, and I guess you said that your strategy is working well with trend following, so is another reason you could like.

https://www.amazon.com/Long-Good-Buy-Analysing-Markets-ebook/dp/B086Z82KRW

A couple of compliments, you can skip 🙂 My quite deep wish is that you could enjoy this book, because what you give to us is not ability to make money, but the attitude to trust the others. Trading is spirituality and knowledge of ourselves I guess, and you show to all of us your loyal followers a magnificent state of mind in sharing your beautiful momentum strategy, as momentum is the music, the mating dance, and the attraction and repulsion of magnetic charges. Yesterday I was really moved when found out you took some time in twitter to share exactly your scan parameters. Facilitating knowledge to who really want to learn is in my opinion the most perfect form of platonic justice, and also the best way to further consolidate the proper knowledge of a topic. Grazie Kristjan to be such a nice contrarian. Happy trading.

Kristjan Kullamägi

Thank you!

Aakash

“Recent history has been kinder to equities. Since 1980, the annual return on equities in these 16 countries was 10.7%, compared to 6.4% for housing.”

Logically speaking, returns from buying up land, setting up bussiness in hopes of generating higher profit should be greater than buying up land, building house and renting it out. Otherwise companies will stop setting up factories and start rental bussiness instead.

Can you see any faults with this reasoning ?